bisnisindonesia.id, (INDONESIA) – Bali’s Property Allure Draws Foreign Developers to Build Luxury Villas By Yanita Petriella

Bisnis, Jakarta – In recent years, particularly following the Covid-19 pandemic, Bali has experienced a surge in foreign investors looking to develop residential properties, particularly villas. This heightened interest from investors aligns with the substantial demand from both foreign citizens (WNA) and Indonesian citizens (WNI).

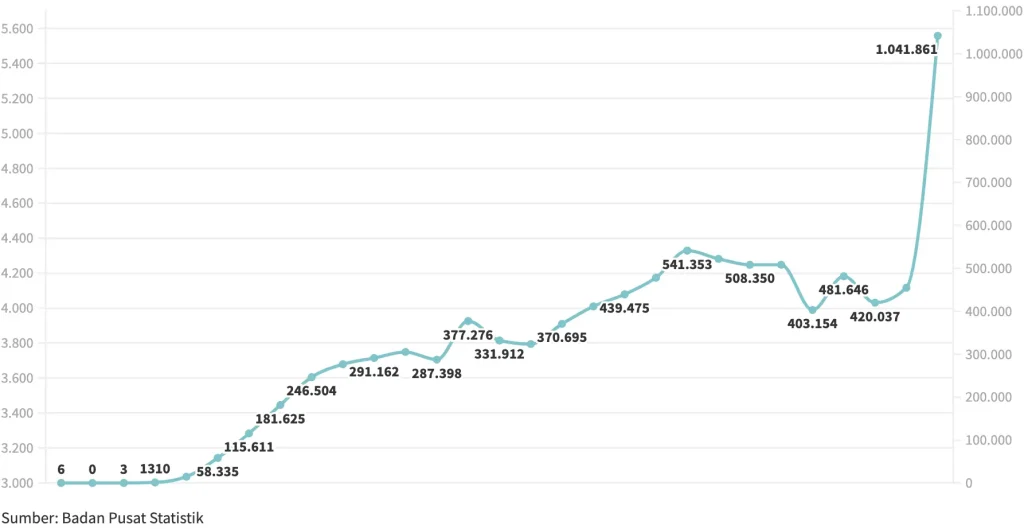

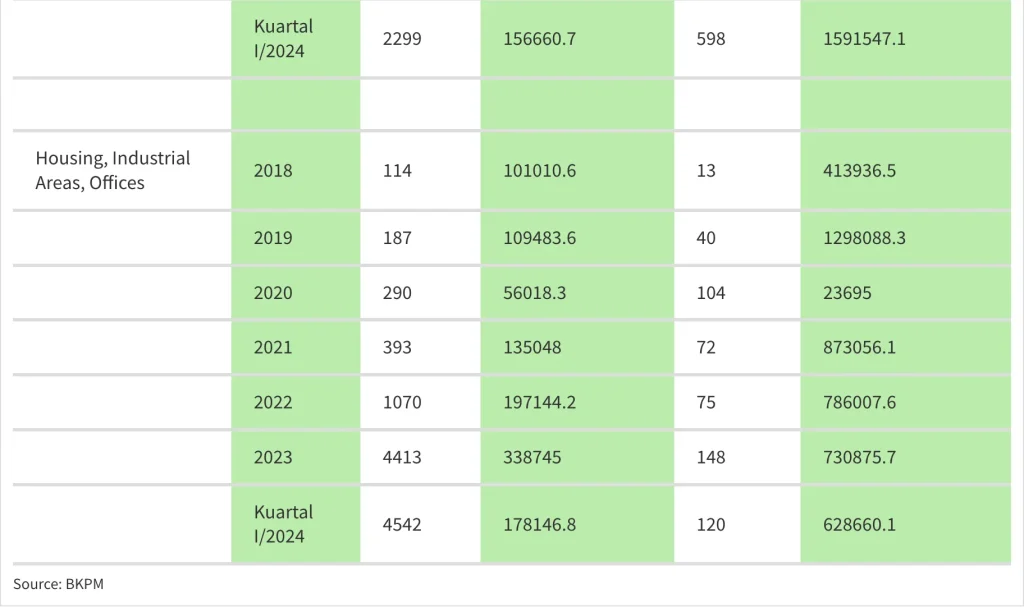

According to data from the Investment Coordinating Board (BKPM), the investment value realization in housing, industrial areas, and office sectors from foreign investment (PMA) in the Q1/2024 amounted to US$178,14 billion. Meanwhile, domestic investment (PMDN) reached Rp628,66 billion during the same period.

In 2023, the investment realization in the residential, industrial, and office sectors for PMA reached US$338,74 billion, a significant increase from the US$197,14 billion recorded in 2022. Conversely, PMDN investment realization in 2023 amounted to Rp730,87 billion, a slight decrease from Rp786 billion in 2022.

For the hotel and restaurant sector, PMA investment realization in the Q1/2024 stood at US$156,66 billion, while PMDN reached Rp1,59 trillion. Throughout 2023, PMA investment in this sector amounted to US$219,8 billion, showing growth from the US$121,9 billion recorded in 2022. Similarly, PMDN investment in 2023 reached Rp2,58 trillion, up from Rp2,38 trillion in 2022.

CEO of 99 Group Indonesia Wasudewan acknowledges the substantial presence of foreign developers in Bali, particularly offering residential properties such as villas.

These developers primarily originate from Ukraine, Russia, Denmark, and various other European nations. Their villa projects in Bali often rely on private financing and target buyers predominantly from their respective countries of origin.

“For example, a Danish developer constructing properties ranging from 20 to 20 units, with approximately 90% sold to Danish clientele. Why not to local? Because, the demand is high in Denmark. With prices starting from Rp5 billion, it is considered relatively affordable Danish,” he told Bisnis, Sunday (19/5/2024).

Bali’s allure lies in its blend of facilities and exotic charm, enticing foreign buyers to consider it as a destination for a second home. This trend has contributed to Bali becoming one of Indonesia’s regions witnessing a property boom, with significant growth observed in areas like Canggu, Tabanan, Uluwatu, among others.

Additionally, Bali boasts remarkably high yields, ranging from 11% to 15%, surpassing those of other regions like Jabodetabek and Bandung. For instance, with a villa priced at Rp3 billion, rented out at Rp,.5 million per day, and maintaining a minimum average occupancy rate of 50%, investors can expect returns ranging from 11% to 15%.

“Unlike investing in a shophouse with a yield of 3% to 5%, in Bali, it can reach double digits depending on the location. Spending IDR 3 billion in Kemang, Bekasi, Bandung, and Bali can yield high returns, with Bali potentially reaching double digits,” noted Wasudewan.

He also highlighted that whether the property is offered on a leasehold or ownership basis, it doesn’t deter both domestic and foreign buyers from investing in Bali’s property market.

“Even with leaseholds of 25 – 30 years, extendable further, the investment remains profitable because Bali’s property investment typically yields returns within 6 – 7 years, with double-digit yields. This isn’t the case in cities outside Bali, where you might have to wait 15 years for your investment to yield returns, which is why many opt for property investment in Bali,” he emphasized.

Discussing prices, he referred to Resale Price Index (RPI) data from Denpasar, indicating fluctuating price trends since 2020. However, in 2022, the inflation rate in Denpasar surged significantly, resulting in a stagnant price trend unable to consistently surpass the price index from 2020.

“This aligns with the contraction experienced in the tourism sector and prevailing economic conditions. Throughout 2022, the RPI remained below the Consumer Price Index (CPI),” he commented.

The introduction of new regulations permitting foreigners to reside in Indonesia through second home visas and golden visas, facilitating easier access for foreign residents and investors, has led to a notable uptick in the RPI. In fact, by October 2023, it surpassed the CPI.

“In April 2024, the year-on-year (YoY) price growth in Denpasar reached 17%, with annual RPI growth recorded at 12,9%, surpassing annual inflation,” he stated.

Wasudewan further elaborated, from January to mid-May 2024, the highest trend in residential demand in Bali was observed in Denpasar at 28,3%, followed by Gianyar at 10,86%, Tabanan at 7,99%, and Buleleng at 3,64%. Concurrently, the highest supply was noted in Denpasar at 23,59%, Gianyar at 8,81%, Tabanan at 6,7%, and Buleleng at 2,07%.

“In general, the demand trend in Bali based on property types indicates that houses and villas account for 57,42%, vacant land for 37,94%, shophouses for 2,24%, and commercial areas for 1,88%. Regarding price preferences, properties ranging from Rp1 billion to Rp3 billion constitute 34,6% of the demand, those above Rp3 billion reach 22,98%, between Rp400 million to Rp1 billion is 22,46%, and thosebelow Rp400 million account for 6,28%,” he outlined.

Investment Realization in Bali Province

Strong Domestic Market

Director of Hospitality Services at Colliers Indonesia Satria Wei is optimistic about the property prospects in Bali, asserting that demand from both investors and end users remains robust, spanning the domestic and foreign markets. He highlights Bali’s enduring appeal as a premier tourist destination in Indonesia, positioning it as a top choice for investment and residential living alike.

“While villas and properties in Bali typically cannot be owned outright, being predominantly available for long-term leases or rights of use, the island continues to captivate foreign investors seeking opportunities in its flourishing real estate market. In recent years, investors from Japan, South Korea, and Australia have shown keen interest in acquiring property in Bali,” he told Bisnis.

Satria noted that the substantial presence of foreign developers in Bali stems from the considerable and promising real estate opportunities in Indonesia, particularly amplified during the Covid-19 pandemic. Initially focusing on foreign buyers, these developers have recognized the significant potential within the domestic market for property investment in Bali.

As a result, they have expanded their focus to include not only foreign but also domestic buyers.

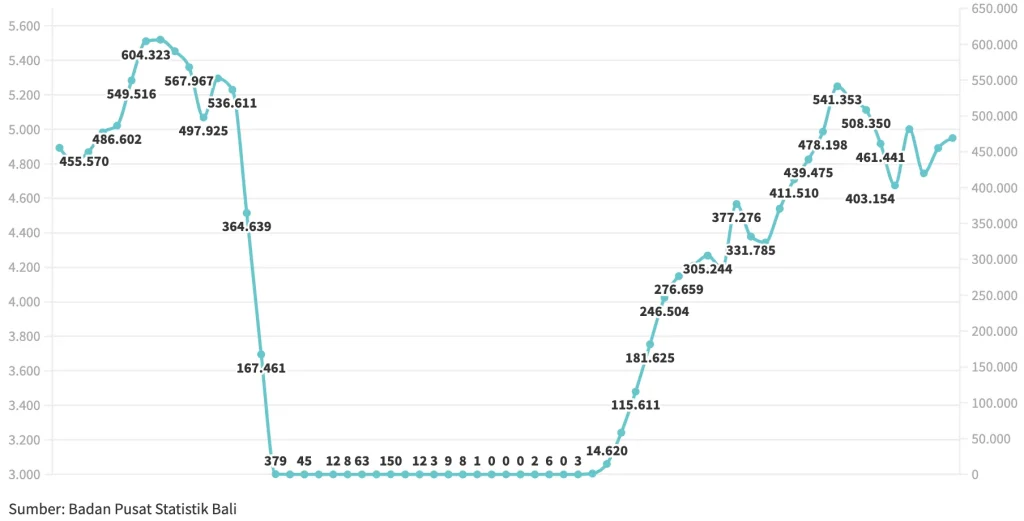

He evaluated that the robust supply and demand dynamics in Bali's residential property market were further propelled by the ongoing recovery of tourist arrivals post the Covid-19 pandemic. Remarkably, tourist visitation figures are nearing pre-pandemic levels.

Moreover, massive infrastructure projects in Bali, including toll roads, new airports, and proposed light rail transit (LRT) systems, are contributing significantly to the burgeoning property market on the island.

“Significant destination expansion is underway in Bali. Take, for instance, Nuanu City spanning 50 hectares in Tabanan, designed as a residential enclave rooted in community and cultural values. In addition to cultivating a more sustainable environment by fostering collective awareness of green, natural, and cultural elements,” explained Satria.

Senior Research Advisor at Knight Frank Indonesia Syarifah Syaukat highlighted that villa properties in Bali present a promising and strategic investment opportunity the pandemic. Returns on Investment (ROI) in Bali can achieve a minimum of 10%, with average occupancy rates reaching 70% annually.

Presently, the potential for property development extends beyond renowned areas like Kuta, Seminyak, or Ubud. The proliferation of new tourist destinations has paved the way for emerging areas, expected to undergo rapid development in the coming years, such as villas in the Canggu region.

“Bali ranks among the top 5 destinations poised for property growth this year. Other cities include Jakarta, the Nusantara Capital City (IKN), Surabaya, and Tangerang,” she elaborated to Bisnis.

The property market demand in Bali isn’t solely driven by foreign investors; domestic buyers also play a significant role. Despite the relatively high average price of villa properties in Bali, exceeding IDR 5 billion, the purchasing power of the domestic market remains robust.

Citing data from The Wealth Report 2024, the growth of Ultra High Net Worth Individuals (UHNWI) in Indonesia reached 4,2% (YoY) in 2023, surpassing the growth rate in the broader Asian region for the same period, which stood at only 2.6% (YoY).

UHNWIs from Indonesia are particularly interested in investment projects from safe haven countries. Moreover, they tend to gravitate towards the residential sector, including housing for both personal use and investment purposes.

“With the notable rise in tourist arrivals in Indonesia, there’s a potential uptick in occupancy rates for properties like hotels and villas across various Indonesian tourist destinations. This trend is sparking heightened interest in investing in such property types,” remarked Syarifah.

Number of Foreign Tourist Visits to the Island of Bali

January 2019 – March 2024 (Ngurah Rai Airport and Sea Port)

Massive Expansion

Chairman of the Regional Management Council (DPD) of the Real Estate Indonesia (REI) Bali I Gede Suardita acknowledged the significant presence of foreign developers engaged in building property in Bali. However, he emphasized that these developers must adhere to the regulations and spatial planning guidelines established in Bali.

“The growth of the property sector in Bali is primarily fueled by the resurgence of tourism and economic recovery,” he told Bisnis.

CEO of Oxo Group Indonesia Johannes Weissenbaeck holds an optimistic view regarding the property market on Bali, citing its resilient recovery from various challenges such as bomb tragedies, volcanic eruptions, and the Covid-19 pandemic.

“We believe that the property development landscape in Bali is influenced by both government regulations and infrastructure development plans. We remain committed to adhering to regulations and collaborating closely with the local government and community to ensure that our property projects align with the established guidelines,” he stated during an interview with Bisnis.

The allure of Bali’s diverse natural and tourism attractions has shifted the preferences of foreign tourists, who now favor longer stays at properties. Proximity to the airport is no longer the primary concern for these visitors.

Capitalizing on this promising property landscape, Oxo Group has decided to expand its footprint by embarking on its 8th project in Bali. Located in near the Nuanu City Tabanan area, the project, named Oxo The Residences, will encompass 40 villa units spread across 2 hectares of land.

These units will building areas from approximately 193 square meters to 293 square meters on land areas of 300 square meters to 643 square meters.

Scheduled for a grand launch on June 8, the Oxo The Residences project represents a significant development endeavor, with an estimated value of up to Rp500 billion.

Construction is slated to commence in October 2024, aiming for completion in approximately one year and nine months, with a target completion date set for mid- 2026.

“Preparations for construction will be underway beginning August. We collaborate with renowned architect Alexis Dornier from Germany. This project aims to blend neo luxury elements with distinctive Balinese characteristics in its design,” Johannes concluded.

Oxo Group Indonesia oversees 7 projects and manages approximately 30 properties across Bali, valued at Rp700 billion. These properties encompass various types such as private residences, villas, townhouses, co-working studios, resorts, and even include a 20-meter-long cruise ship located in Komodo National Park.

In contrast to previous endeavors, Oxo The Residences will primarily focus on attracting approximately 80% of its buyers from the domestic market, with the remaining 20% targeted towards foreign buyers.

This marks a departure from earlier projects where the emphasis was on capturing 80% of the foreign buyer market. The foreign clientele typically hailed from countries such as Singapore, Australia, the United States, Japan, and Europe.

The shift in strategy was prompted by the recognition of significant untapped potential within the domestic market, particularly among buyers from Jakarta, Surabaya, and Medan.

“We’re targeting three key market segments: those seeking permanent residence, holidaymakers looking for temporary stays, and investors who may be influenced by personalities such as influencers, artists, and entrepreneurs,” he explained.

Johannes pointed out that prior to the Covid-19 pandemic, Indonesian citizens tended to prioritize vacations abroad. However, with travel restrictions in place during the pandemic, many Indonesians turned to Bali as their primary vacation destination. This shift has led to an increasing number of Indonesians considering the potential for property investment in Bali.

Oxo Group is committed to delivering promising capital gain potential with its new projects, estimating an average of 8% over a 10-year period, based on occupancy levels ranging from 56% to 72%.

Johannes expresses confidence that the new project, priced between Rp7,5 billion and Rp15 billion, will be fully absorbed despite the challenges posed by escalating geopolitics, the global economy, and BI rate, which has risen to 6.26%.

“This project stands out from others in Bali, and we are marketing it with a freehold system or Certificate of Ownership (SHM), whereas currently, most properties in Bali offer a leasehold system,” said Johannes.

Investera Australia CEO Prisca Edwards leading the sales and marketing division of the Oxo The Residences project, is optimistic about its market absorption.

“I see significant potential among potential buyers from Jakarta, Surabaya, and Medan, in addition to Bali itself. In fact, the number of Expressions of Interest (EOI) received since April 23 has surpassed our targets and expectations,” she stated.

Occupancy Rate or Hotel Occupancy in Bali

January 2019 – March 2024 (All Hotel Classes)